If you think you can’t get your financial brand out there without an advertising budget, you’re in for a pleasant surprise.

Don't get me wrong. Running ads does help, especially in getting your brand in front of prospects in the shortest time possible. In fact, the financial services sector spends more on online advertising than any other industry.

But in an oversaturated market, going with the tide may not be the best strategy. Besides, trends show that ads are becoming less effective over the past few years. If you want to cut through the noise, go organic with your financial services marketing instead.

What is Financial Marketing?

Simply put, financial marketing is a form of marketing that employs strategies and practices that generate buzz and build an audience around a financial brand.

Why Organic Marketing is Key in an Oversaturated Market

If you think you can’t get your financial brand out there without an advertising budget, you’re in for a pleasant surprise.

Don't get me wrong. Running ads does help, especially in getting your brand in front of prospects in the shortest time possible. In fact, the financial services sector spends more on online advertising than any other industry.

But in an oversaturated market, going with the tide may not be the best strategy. Besides, trends show that ads are becoming less effective over the past few years. If you want to cut through the noise, go organic with your financial services marketing instead.

What is Financial Marketing?

Simply put, financial marketing is a form of marketing that employs strategies and practices that generate buzz and build an audience around a financial brand.

Why Organic Marketing is Key in an Oversaturated Market

With the right financial marketing strategies and a bit of grit, you can generate buzz around your financial brand, reach out to potential customers, and more importantly, have the revenue to show for your efforts—without running a single ad.

Let’s go over the reasons why.

Organic marketing makes you more trustworthy

Organic marketing is the best strategy to get customers to trust your brand. Why? Because it’s more authentic. When you publish content that aims to inform, entertain, and educate—instead of asking for the sale—you’re making it clear that you have your audience’s best interests in mind.

Organic marketing, unlike paid advertising, focuses on building meaningful relationships. When you're out there helping out and not sounding like a pushy car salesman, potential customers are more likely to get their defenses down. They become more receptive to your message and feel more inclined to engage with your brand.

Organic marketing is a long-term game

If you’re not running ads, don’t expect your marketing efforts to generate results overnight. Organic marketing is a long-term game. You need patience, grit, and consistency for your marketing efforts to pay dividends in the long run.

While organic marketing requires time, patience, and grit, the long-term benefits are big. After all, you’re not just building relationships, you’re also building brand equity and authority with your customers, which all translates to higher margins.

Effective Financial Services Marketing Strategies—No Ads Needed!

Here are powerful financial services marketing strategies that will give you an edge over the competition even without running a single ad.

Leverage Content Marketing

Content is king, amirite?

You’ve probably heard that a thousand times. Just because you’re sick of hearing it doesn’t mean it’s not true.

But content is not a magic pill. You need a sound content marketing strategy for your content to move the needle for your financial business.

The goal of content marketing is this: create timely, useful, and relevant content for your target audience. It’s simple, really. If you want your audience to care about your brand, publish content they will care about. Content that will change their lives for the better.

People need help with their finances. The problem? Financial matters are complex, confusing, and boring. This is an opportunity you can’t pass up. By providing them with engaging content that improves their financial lives in some way, you earn the attention needed to start a profitable and meaningful relationship. One that may lead to an eventual sale, if you play your cards right.

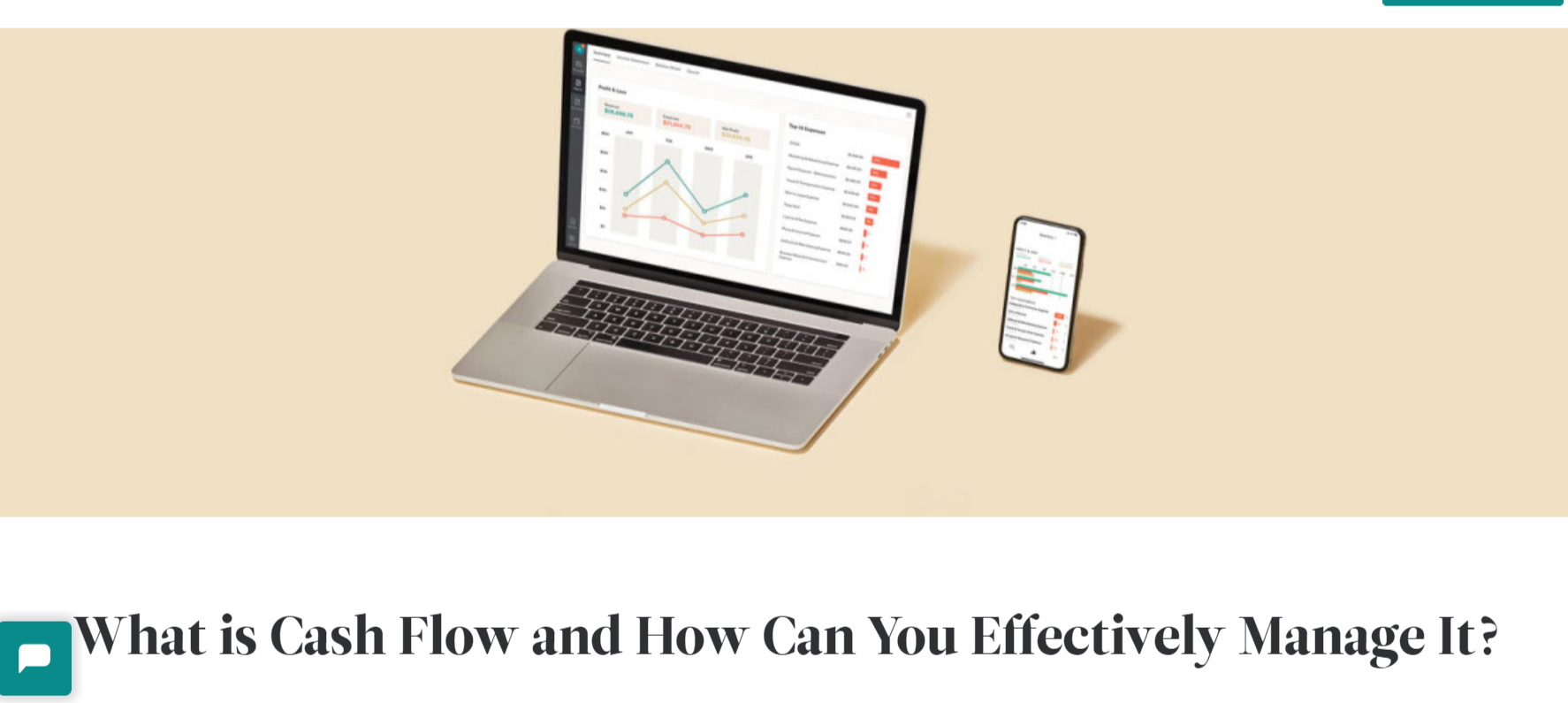

Take a look at this blog post by Bench Accounting. The topic (“What is Cash Flow and How Can You Effectively Manage It?”) works because it’s helpful to their target audience: small businesses.

By explaining what cash flow is, how to read a cash flow statement, and how to manage their cash flow, Bench Accounting has addressed a pain point most small business owners have: inconsistent cash flow. It’s timely, relevant, and valuable. The blog post was relatable, engaging, and value-packed, showing readers that the company knows what it’s about.

Know your audience

You can’t deliver timely, relevant, and helpful advice if you don’t even know what makes your customers tick. So get to know your audience! Once you have enough customer data, create buyer personas so you can tailor your content to fit your audience.

Develop content for every stage of the customer journey

It takes 6-8 touchpoints to make a sale. Here are the three stages of the customer journey and the best types of content to make those touchpoints count (as mentioned in our Content Marketing Tips for Financial Services Companies blog post).

- Awareness Stage Content: Blogs, checklists, videos, infographics

- Consideration Stage Content: Case studies, comparison tables, spec sheets, webinars

- Decision Stage Content: Free trials, pricing information, concept proof, demonstrations

Use the Power of Personalized Email

The financial services sector is highly competitive. Banks are not only competing with each other, but also with trust companies, credit unions, life insurance businesses, and more.

In terms of financial services, consumers are offered many choices.

Without an advertising budget to put your financial brand in front of prospects, how do you compete?

Try email marketing.

Why? Because email marketing has the highest ROI out of all marketing channels, generating an average of $36 for every dollar spent. According to eMarketer, 80% of professionals, email marketing is the main driver of customer acquisition and retention. Better yet, financial clients prefer emails when communicating with financial brands.

So, why is email marketing so effective? Because email is tops when it comes to delivering personalized and targeted content. In fact, 80% of customers are more likely to buy from a brand that delivers personalized experiences. Additionally, 72% of customers will only respond to personalized marketing messages.

By using email marketing automation tools like MailChimp, MailJet, or ActiveCampaign, your financial brand can gather data from customers. You can then use that data to segment your audience, and in turn, tailor your emails to fit the needs of each customer profile.

Use Social Media to Reach Your Target Audience

There are now 4.5 billion social media users around the world. Going by that figure, it’s a good bet many of your potential customers are on social media.

And considering that over 75% of millennials now use social media to make buying decisions, is it any wonder 61% of financial service marketers plan to increase spending on social media marketing?

No two ways about it -- if you want to expand your reach and generate more sales, build a social media presence.

How do you build a social media presence that allows you to monetize your audience? You can start by publishing engaging, entertaining, and helpful social media content. Keep doing this and you can grow your brand reputation and stay top of mind among your target audience. Do this consistently and your prospects are likely to buy or sign up for your financial service once they’re ready.

A few tips on how to build your financial brand on social media:

- Pick the right platform. You don’t have to build a social media presence on every platform out there. To pick the right platform/s, identify who your target audience is, where they hang out, and what types of social content you want to produce.

- Use visuals. Add high-quality images to your posts to capture more attention and boost engagement. Create top-notch images by using Canva, Snappa, or Crello.

- Stay on-brand. If you want to leave a lasting impression, stay consistent with your branding. Maintain a consistent voice and visuals in your social media posts so you can differentiate your brand from your competitors.

- Be human. Customers crave authentic experiences more than ever, especially from financial brands. If you want to build real, genuine connections on social media, ditch the jargon and be human instead.

Charlie Finance's tweet below is a perfect example of how to be human on social media. By posting a fun image and accompanying it with a witty caption, the company was able to empathize with their target audience's debt struggles in a fun, relatable way.

Design Content with SEO in Mind

Right now, many of your potential customers need help with their finances. The kind of help you can give. If you’re given the opportunity to help solve their financial woes, you’re better off taking it. After all, there’s no better way to build authority and credibility.

But before you get to that point, your prospects need to find you first. And since most of them are using Google to get their answers, you need to rank higher in search.

How do you pull this off? By doing keyword research! The rules are simple: the higher you rank for keywords relevant to your niche, the more website visitors you get, and the better chances of conversions.

The key is to optimize your content for keywords your prospects are likely to use when searching for answers you can provide. By optimizing content around relevant keyword phrases, you give your brand opportunities to show up on relevant searches.

You need to optimize for keyword phrases that satisfy the search intent of your target audience. For maximum results, make sure that you map the search intent to the customer journey.

That said, keyword research can get a little tricky when you’re optimizing SEO for a competitive, over-saturated market. So if you want your SEO campaign to yield results, optimize for low-competition keywords (or long-tail keywords). Low-competition keywords are the low-hanging fruit of keyword research. Because they have relatively lower search volume, they are easier to rank for.

If you know your audience enough and delve deeper into their searching habits, you may discover low competition keywords with high traffic. This SEMRush blog post provides an in-depth guide on how to find these “sweet spots.”

Pro Tip: Forming strategic alliances with influencers and business partners is a great way to build high-quality backlinks, which will make it easier to rank new content.

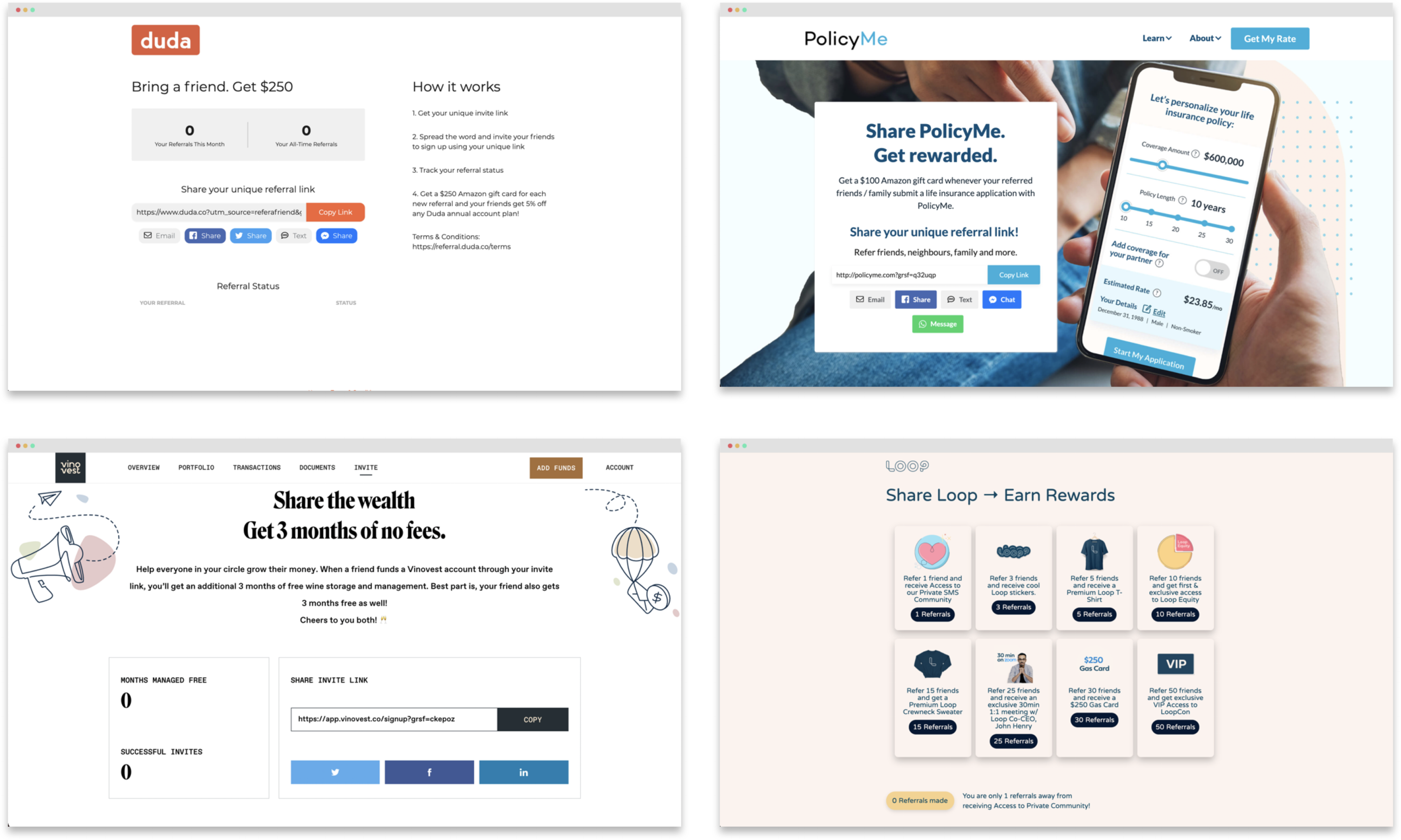

Leverage Trust with Referral Marketing

While trust in the financial services sector is at its highest as it’s ever been since the 2008 global financial crisis, history shows that this trust is on shaky ground.

Given this reality, as a financial brand, how do you earn and keep the trust of your audience?

Two words: referral marketing.

Why? First off, 92% of people trust recommendations from friends and family more than other forms of marketing.

What if you can leverage the trust that customers have for each other?

This strategy has been effective so far. After all, referral marketing is three to five times more likely to convert than any other marketing channel.

To top it off, referral marketing allows you to acquire high quality customers at a low cost, not to mention yield a high retention rate. Simply put, referral marketing is a powerful channel for acquiring customers and generating ROI.

Here are a few tips to boost your financial service’s customer acquisition at a low cost through referrals:

- Be referral-worthy. An effective referral marketing campaign starts with satisfied customers. If they’re not happy with your financial services, why would they bother sending you referrals?

- Develop and nurture customer relationships. The best referrals are based on genuine relationships. Meet and exceed your customers’ expectations and they’ll go out of their way to send referrals every chance they get.

- Ensure everyone gets rewarded. What’s in it for everyone? Offering double-sided incentives provides customers the added motivation to keep sending referrals. Referrals are more likely to accept the referral invite if they receive some reward too. More importantly, pick the right referral incentives!

- Make it easy for customers to refer you. Customers are lazy. So don’t make them work hard to refer you. Give them a unique referral code so they can make referrals using any platform they choose. Give them clear instructions on how to participate and make the entire process transparent.

- Use a referral program software. Use an automated plug-and-play referral solution to automate your referral program from end to end. That way, you can focus on high-value tasks that will move the needle for your financial business.

Willful, for example, achieved a net return of 312% on their referral program since signing up with GrowSurf. The referral program software gave the fintech company the high visibility they needed to track their KPIs and referrals. Thanks to the referral platform’s in-depth analytics, Willful made the right tweaks and adjustments to improve their channel performance and conversion rates.

For a more comprehensive guide on how to do referral marketing right, check out our B2B referral program guide.

Key Takeaways

The financial sector is changing fast. As new technologies and platforms emerge, businesses must continue to adapt to the changes to stay afloat. It can get scary out there, especially if you don’t have an advertising budget.

But even while things change at an accelerated rate, one thing stays the same: customers crave real, genuine relationships. Want to market your financial services successfully? Use the following marketing strategies to your advantage:

- Leverage content marketing

- Use the power of personalized emails

- Use social media to reach your target audience

- Optimize for SEO

- Leverage trust with referral marketing

Good luck!

Build your customer referral program without the dev time

Sign up for a free trial of GrowSurf to lower your customer acquisition costs, increase customer loyalty, and save gobs of time.